Why are Coffee Prices so Volatile?

About a week ago I was sitting in my favorite local coffee shop sipping my latte, when I overheard the owner discussing rising coffee prices with a barista. “I hate to do it, but I might have to raise prices again,” he said. “These wild swings in coffee costs are killing me.”

As a coffee lover and blogger, his casual conversation led me down a rabbit hole in the volatile world of coffee pricing.

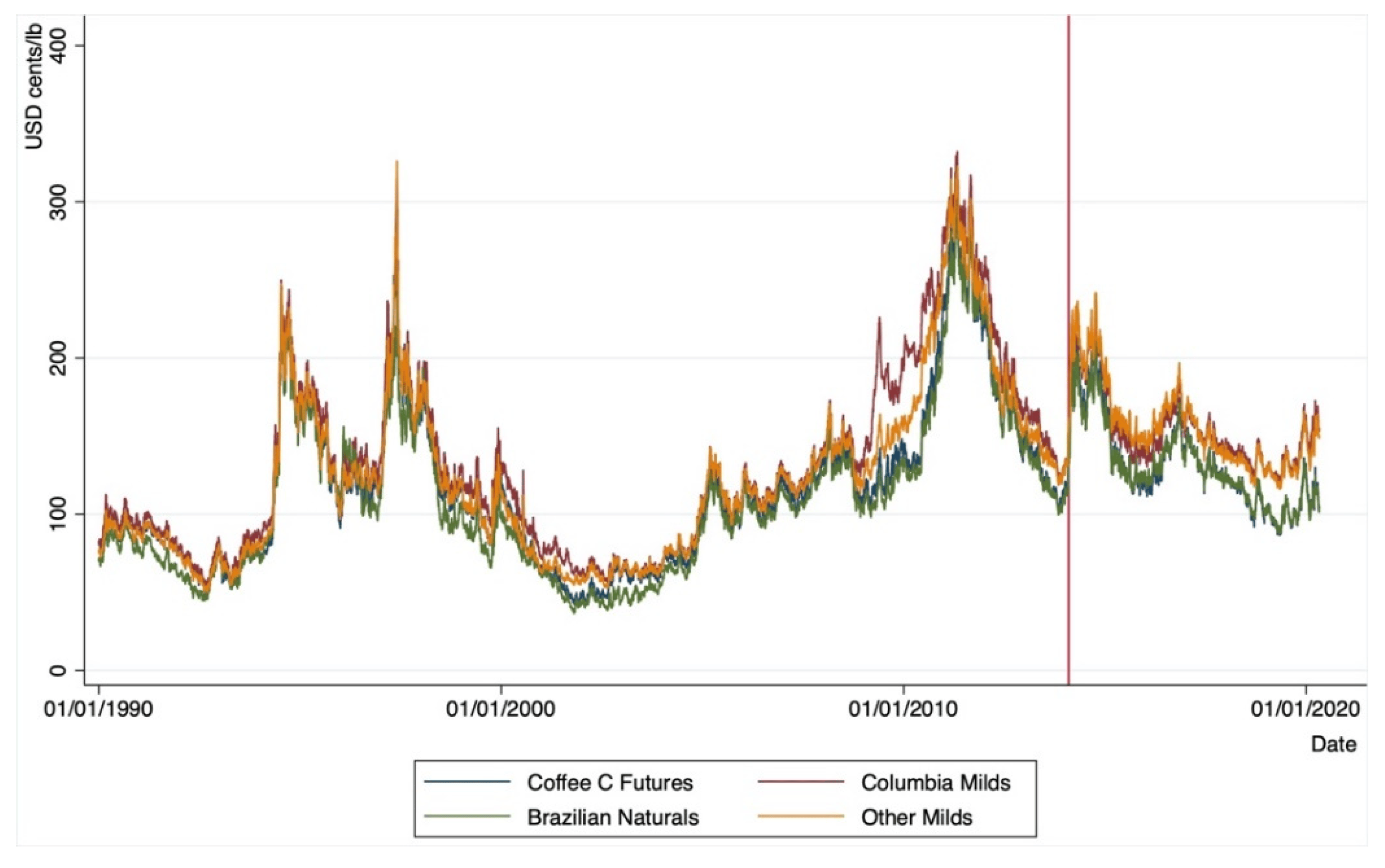

I found out that coffee prices are notoriously unstable, often experiencing dramatic fluctuations in short periods.

This volatility is due to 7 reasons:

1. Supply and Demand Imbalances

The coffee market is highly sensitive to changes in supply and demand.

As a perennial crop, coffee plants take years to mature, making it difficult for producers to quickly adjust supply in response to market signals.

2. Climate

Coffee is extremely vulnerable to weather conditions. Droughts, frosts, and excessive rainfall can significantly impact crop yields.

For instance, a severe frost in Brazil in July 2021 caused coffee prices to skyrocket.

3. Geopolitics

Political instability or economic crises in major coffee-producing countries can disrupt production and supply chains, leading to price spikes.

4. Currency Fluctuations

As coffee is traded internationally, exchange rate variations can affect its price in different markets.

5. Speculative Trading

The coffee futures market is subject to speculative activity, which can amplify price movements.

6. Long-term Climate Change Impacts

Rising global temperatures and changing weather patterns pose a significant threat to coffee production, potentially leading to more frequent supply shocks and price volatility in the future.

7. Market Structure

The coffee market’s structure, with its inelastic supply and demand, makes it particularly susceptible to price swings. When supply or demand shocks occur, prices can move dramatically to reach a new equilibrium.